The growth in apartments in Hong Kong is very slow, much slower than the growth of the overall population, which grows by about 0.4% per year. Between April 2012 and March 2013, the government sold land worth 50 bio HK$ with a size of 256,167.5 m², an area of about 500 by 500 meters, which is about 1.3 times the size of Victoria Park. Given the size of Hong Kong’s developed area, that estimates to a growth of 0.1%. A city where the population grows four times as fast as the inhabited area is bound to have a serious issue about the affordability of apartments.

Looking south-west from Shek Kip Mei over newly developed West Kowloon.

Government housing complexes, called Estates from various epochs.

100,000 people live in such dwellings to due unaffordable housing.

If we look at the newly created apartments individually, the problem becomes much more visible. On April 10, the Hong Kong Government sold land as residential sites to developers. Two sites, one of 14.000 m², the other of 3.000 m² were sold at a total of 2.502 billion HK$. Interestingly, none of the two companies (Great Horwood Limited and Smart Touch Investments) have any web presents, the later was only formed in September 2012 while the other seems to have been in business since 2004. All shadiness aside and forgetting the quite urging question why buying land in Hong Kong requires a complicated nested corporate structure, we look at the few numbers from the two land sales individually.

Most importantly, both land parcels are not technically sold. You cannot really own land in Hong Kong, you can only lease it from the government. As the Land Tenure System and Land Policy explains unusally well, you can lease land from the government in intervals of 50 years (some leases run on 75, 99 or even 999 years), and when the lease expires you have to pay again. This ensures the government can keep control over what happens on the land without having to infringe on property rights, and at the same time make sure to have an eternal constant revenue stream. Having said that, land sales in Hong Kong (like on the Chinese Mainland) act like a general tax on living in Hong Kong. It is very hard to analyze who bears that tax, as it is difficult to assess what prices are affected through higher land prices. Rent definitely, but land intensive and inefficient businesses like pubs or galleries are also very like to over proportionately bear this tax.

The larger site that was auctioned this April is almost 14,000 m² large, which is about half the size of the infamous Kowloon Walled City. But while the Kowloon Walled City had about 33.000 residents, the new buildings in Tseung Kwan O will only have around 655 apartments, at about 70 m² each. Why so few? Even if the apartments in the Kowloon Walled City had been as large as the ones in the new Tseung Kwan O building (In reality most were around 25 m²), and the Walled City as a whole only the same size, it would have been able to house approximately 5000 people, around 4 times as many for the entire building. The truth is that modern Hong Kong apartments are built quite space inefficiently, and while they rise high, they rarely have more than 2-4 apartments per floor. Each 1 m² of the new complex costed the developer around 47,000 HK$ in taxes (or rather, license fees), meaning that an average apartment includes 3.3 mio HK$ in taxes to the government. That’s quite a burden in a city where 50% of the population make less than 10,000 HK$ per month, though admittedly that is not taxed at all.

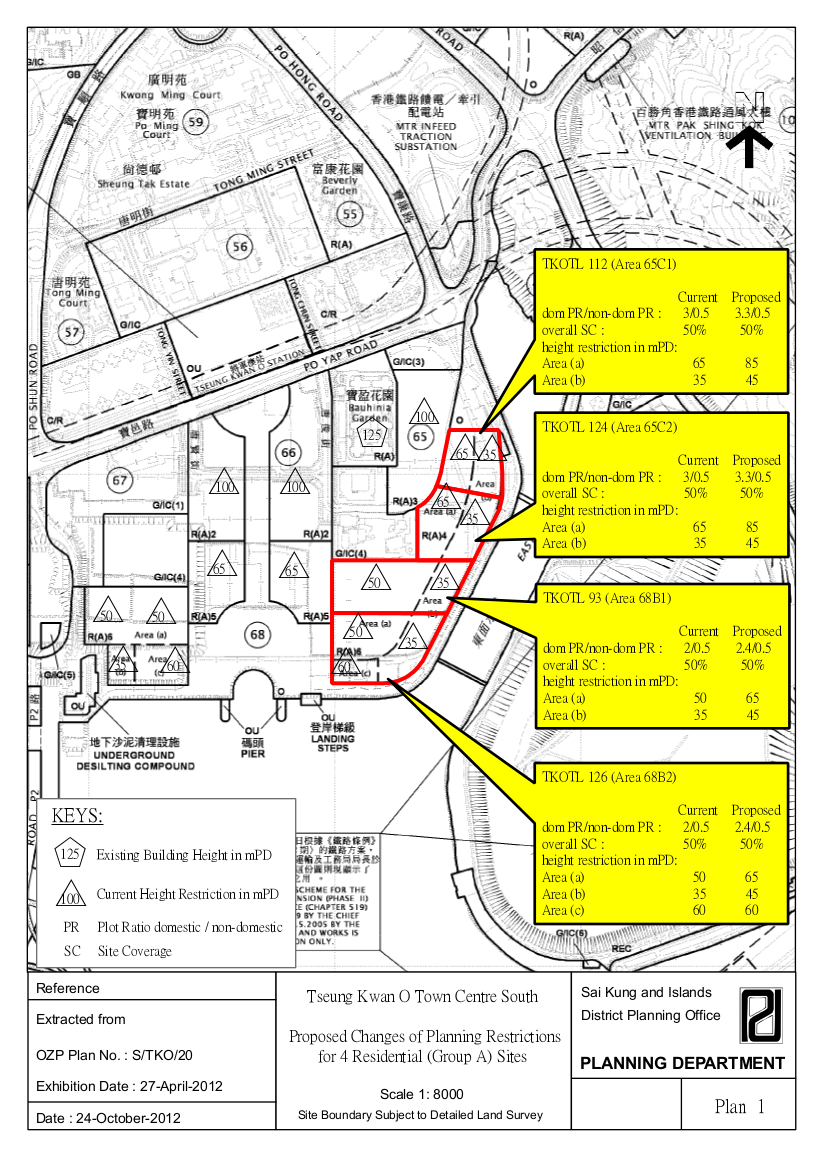

Tseung Kwan O, proposed land use, height restrictions.

Tseung Kwan O, proposed use of land.

The area comes with significant height restrictions, 85 meters. That way the government can expect an additional source of revenue if the developer decides to redevelop the area in the upcoming 50 years. Also, there is a control aspect attached to this, as we can see in the proposed plans below. (Original here)